More than a month has passed since we left 2024 behind. When we look at the annual production report of the load dispatch center, I think that the profitability of existing energy investments and new energy investments, especially for 2025 and beyond, should be evaluated carefully by investors.

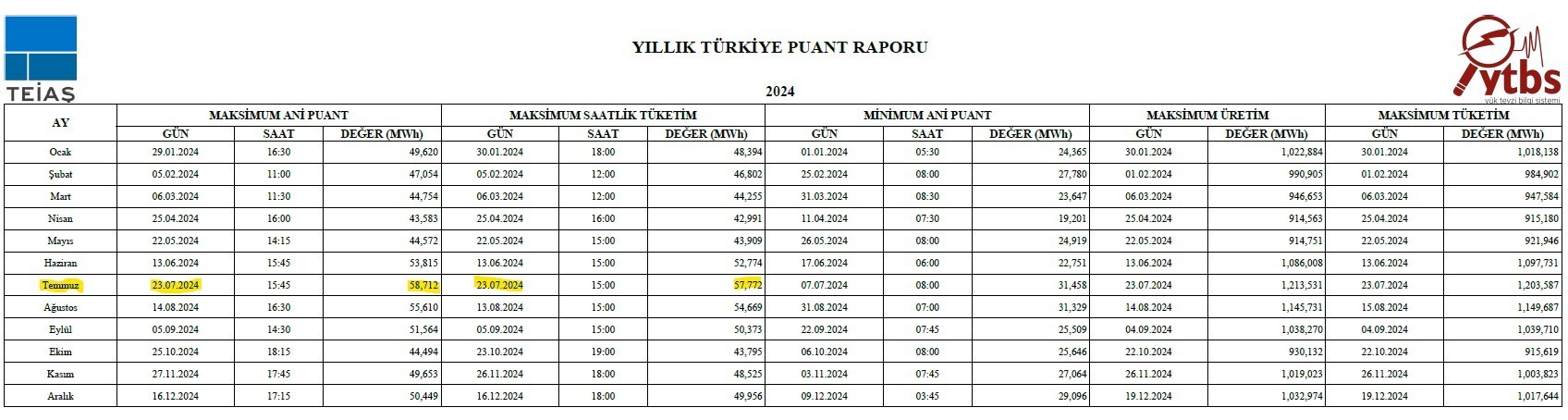

According to TEİAŞ data, the maximum instantaneous peak in 2024 was 58,712 MWh on 23.07.2024, and the maximum hourly consumption was measured as 57,772 MWh on the same day. As of 09.02.2025, Turkey’s installed power is 116,446 MW. The total installed power of RES and SPPs within the current installed power is 33,241 MW.

Especially considering the renewable energy plants that will be commissioned in 2025 and after in line with the 2035 targets, the size of the RES and SPPs planned to be added to the current system will be around 85,000 MW. (The 2035 target was stated as 120,000 MW in the roadmap announced by the Ministry in October 2024.)

In light of all this data, it will be inevitable for the free market electricity sales price to decrease as a result of the aggressive increase in installed capacity at a point where the peak energy consumption does not exceed 60,000 Mwh hours. Although this is a positive development for the consumer and the state, it should be examined carefully, especially for investors. Because the payback periods of most renewable energy projects are over 10 years, and the decrease in income, especially in power plants coming out of YEKDEM, causes cash flow difficulties.

On top of all this, if the consumption side is not supported by industrialization or foreign energy sales, it will be inevitable for us to see 0 or negative electricity prices in the free market in the coming years. Although this is an advantage for the consumer, it is a phenomenon that needs to be seriously examined and modeled for the producer.

I follow all projections on the energy production side with interest and support investments, but I cannot say that I see a holistic approach in a clear and planned manner, especially on how this supply will meet demand on the consumption side.

Although Turkey has a great potential in terms of energy production, it still keeps the need for this area alive. However, improving the transmission infrastructure, increasing industrial investments on the consumption side, increasing electricity sales to abroad and providing a more predictable investment environment for investors will make it easier to reach the expected and planned targets in the medium term.

While zero or negative energy sales price is a reality before us, predictability should be considered a very important element and should be provided as much as possible in order for investors to minimize their risks, invest more aggressively and most importantly, to provide cheap financing.

We will see how this situation will be interpreted by investors in the coming days.